Applying AI to facilitate and secure

the growth of our clients’ financial assets

TRAIDY – Overview and Benefits

TRAIDY is an AI-based trading platform, which currently trades the US stock market; its main features are:

• In a bullish market, it outperforms the standard indices, like S&P500, Dow Jones, etc. by far, and in a bearish market, it limits the losses (please refer to the White Paper for details of the trading results)

• No experience, expertise, or time is needed to achieve this trading success – TRAIDY does it all by itself!

• In a bullish market, it outperforms the standard indices, like S&P500, Dow Jones, etc. by far, and in a bearish market, it limits the losses (please refer to the White Paper for details of the trading results)

• No experience, expertise, or time is needed to achieve this trading success – TRAIDY does it all by itself!

Performance of TRAIDY

Now, one year of live trading has been completed successfully.

The results of these activities and an outlook for the next year can be found in One Year Life Trading.

Please have a look at the report, it summarizes why TRAIDY has one of the best risk-adjusted returns performances in the market.

TRAIDY – FAQs

About TRAIDY

TRAIDY is a fully automated AI-based trading solutions that is designed to maximize risk-adjusted returns.

TRAIDY is designed to capture stock’s trend reversal with the aim to conduct successful trades on the user’s behalf. TRAIDY can detect hidden patterns in historical uptrends and downtrends customized for each stock separately. To this end, TRAIDY has its own original indicators that have powerful capability of anticipating when a stock’s downtrend will stop, and a new uptrend is about to start. Moreover, TRAIDY is dynamic. By design, TRAIDY has dynamic take profit and stop loss thresholds. These thresholds vary from one stock to another; and they are self-adjusted according to prices’ dynamicity.

Moreover, TRAIDY is supported by an intelligent money management module. This module is capable of deciding how much to invest on a daily basis (according to market’s condition). The same module is also responsible for position management.

TRAIDY is fully transparent. The user can see all trading activities in real-time in addition to all portfolio details (e.g., total Market Value of all current holdings, Unrealized PnL for each position and cash available).

The user has full control over their account. For example, if the user wants to withdraw any amount of money, he/she can do it directly from his/her account.

Both paper trading and live trading experiments have proven that the risk management module embedded within TRAIDY is very efficient. At the heart of TRAIDY risk management module are:

a. Portfolio rebalancing part of the risk management. Simply put, TRAIDY to keeps your asset mix correct over time.

b. Money management. TRAIDY uses cash for hedging. It knows how much to invest, and how much to liquidate, on a daily basis.

Such features ensure a high level of risk consciousness of TRAIDY. For instance, when the S&P 500 was down by more than 16% on September 2022, TRAIDY was down by only 10% (as shown in figure 1 below).

In a nutshell, TRAIDY acts like a very good financial advisor who also executes all recommended activities.

FINAID Solution Ltd has its own portfolio, and we rely 100% on TRAIDY to manage it. Figure 1 below denotes the equity curve of our portfolio (compared to SPY).

Figure 1 TRAIDY vs SPY since August 2022 (based on live trading records)

TRAIDY is designed to capture stock’s trend reversal with the aim to conduct successful trades on the user’s behalf. TRAIDY can detect hidden patterns in historical uptrends and downtrends customized for each stock separately. To this end, TRAIDY has its own original indicators that have powerful capability of anticipating when a stock’s downtrend will stop, and a new uptrend is about to start. Moreover, TRAIDY is dynamic. By design, TRAIDY has dynamic take profit and stop loss thresholds. These thresholds vary from one stock to another; and they are self-adjusted according to prices’ dynamicity.

Moreover, TRAIDY is supported by an intelligent money management module. This module is capable of deciding how much to invest on a daily basis (according to market’s condition). The same module is also responsible for position management.

TRAIDY is fully transparent. The user can see all trading activities in real-time in addition to all portfolio details (e.g., total Market Value of all current holdings, Unrealized PnL for each position and cash available).

The user has full control over their account. For example, if the user wants to withdraw any amount of money, he/she can do it directly from his/her account.

Both paper trading and live trading experiments have proven that the risk management module embedded within TRAIDY is very efficient. At the heart of TRAIDY risk management module are:

a. Portfolio rebalancing part of the risk management. Simply put, TRAIDY to keeps your asset mix correct over time.

b. Money management. TRAIDY uses cash for hedging. It knows how much to invest, and how much to liquidate, on a daily basis.

Such features ensure a high level of risk consciousness of TRAIDY. For instance, when the S&P 500 was down by more than 16% on September 2022, TRAIDY was down by only 10% (as shown in figure 1 below).

In a nutshell, TRAIDY acts like a very good financial advisor who also executes all recommended activities.

FINAID Solution Ltd has its own portfolio, and we rely 100% on TRAIDY to manage it. Figure 1 below denotes the equity curve of our portfolio (compared to SPY).

Figure 1 TRAIDY vs SPY since August 2022 (based on live trading records)

Interactive Broker Account

One important pre-requisite of using TRAIDY is to have an Interactive Broker (IB) Account. Here, it is described what needs to be done to achieve this, in the following it is assumed that this is done.

In order to do trades, TRAIDY needs a trading platform – this is the Interactive Broker. If you do not have an account there, please go to their web site and create an account.

Once the account has been created, you shall place the amount of money you wish TRAIDY to manage in this account.

We strongly suggest that the user should create an IB account that is dedicated to TRAIDY. In other words, no buy/sell activities shall be conducted in any way other than TRAIDY on this particular account. In case you didn’t do so before, Interactive Advisors allows clients to open multiple client accounts.

The user does not need to open multiple accounts to invest in multiple portfolios. The user can still have other account(s) on the IB platform, and the user can manage these accounts personally. Please contact the IB’s Client Services team for more information.

In order to do trades, TRAIDY needs a trading platform – this is the Interactive Broker. If you do not have an account there, please go to their web site and create an account.

Once the account has been created, you shall place the amount of money you wish TRAIDY to manage in this account.

We strongly suggest that the user should create an IB account that is dedicated to TRAIDY. In other words, no buy/sell activities shall be conducted in any way other than TRAIDY on this particular account. In case you didn’t do so before, Interactive Advisors allows clients to open multiple client accounts.

The user does not need to open multiple accounts to invest in multiple portfolios. The user can still have other account(s) on the IB platform, and the user can manage these accounts personally. Please contact the IB’s Client Services team for more information.

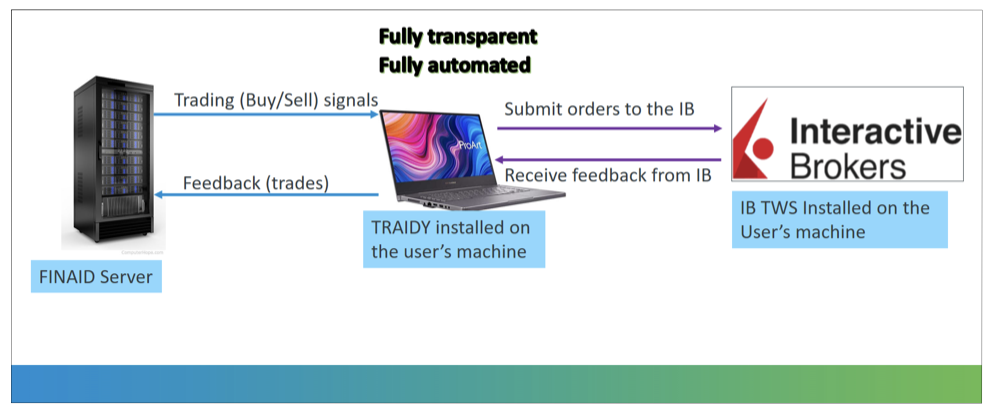

How does TRAIDY function?

TRAIDY is a software that to be installed on the user’s machine. TRAIDY is an AI-based automated software solution to manage user’s portfolio.

To do so, TRAIDY will be connected to the user’s broker and to the FINAID server. TRAIDY will receive the buy/sell signals from the FINAID server and submit them automatically to the broker. TRAIDY will also submit daily feedback about the user’s portfolio to the FINAID server. This feedback is mandatory so that TRAIDY does a “follow-up” to decide A) which stock to sell, at which prices, or B) to increase its position’s size.

To do so, TRAIDY will be connected to the user’s broker and to the FINAID server. TRAIDY will receive the buy/sell signals from the FINAID server and submit them automatically to the broker. TRAIDY will also submit daily feedback about the user’s portfolio to the FINAID server. This feedback is mandatory so that TRAIDY does a “follow-up” to decide A) which stock to sell, at which prices, or B) to increase its position’s size.

TRAIDY’s entire trading activities are fully automated. However, the user needs to ensure that his/her machine has an internet connection whilst the market is open on a daily basis.

TRAIDY is fully transparent. All buy/sell activities will be displayed on TRAIDY’s user interface.

Several reports can be generated by TRAIDY. These reports allow the user to check out the overall performance as well as all trading activities’ details. The user will have full control over his/her portfolio. He/she can close any position or, even, fully liquidate the entire portfolio. However, FINAID does not recommend employing any human intervention to open/close any position.

TRAIDY is fully transparent. All buy/sell activities will be displayed on TRAIDY’s user interface.

Several reports can be generated by TRAIDY. These reports allow the user to check out the overall performance as well as all trading activities’ details. The user will have full control over his/her portfolio. He/she can close any position or, even, fully liquidate the entire portfolio. However, FINAID does not recommend employing any human intervention to open/close any position.

What makes TRAIDY special?

The user’s broker software shall be installed on the user’s machine as well. The current version of TRAIDY support only the Interactive Broker TWS platform.

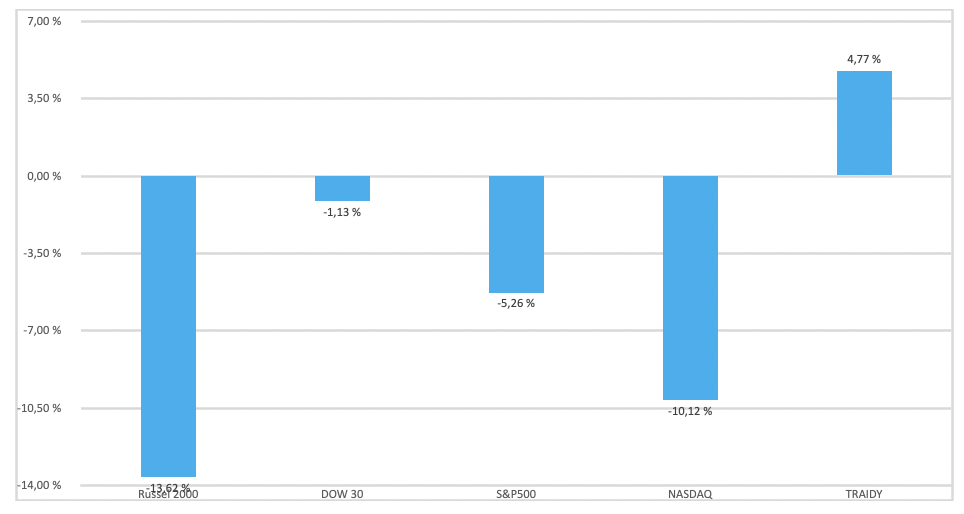

• Live trading performance: FINAID Solutions Ltd started using TRAIDY to manage our own portfolio on 15th August 2022. The chart below shows that TRAIDY is outperforming major indices during the period from 15th Aug 2022 to 26th April 2023.

• Live trading performance: FINAID Solutions Ltd started using TRAIDY to manage our own portfolio on 15th August 2022. The chart below shows that TRAIDY is outperforming major indices during the period from 15th Aug 2022 to 26th April 2023.

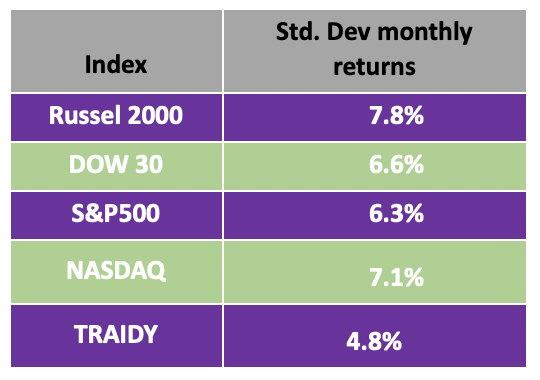

Moreover, TRAIDY has less fluctuation in term of monthly returns as can be seen in Table 1 below.

• Fully AI-based: TRAIDY comprises 3 main AI modules that cover A) buy/sell trading rules, B) money and position management, and C) risk management.

Typically, Robo-advisors do not outperform the market. Read this article and this one. One can check this website for more details on other major robo-advisors’ performances. Most robo-advisors use passive indexing strategies that are optimized using some variant of modern portfolio theory. Typically, they invest in mutual funds or ETFs and adopt the “optimization efficient frontier” mathematical model.

• Fully automated. No user intervention is required. TRAIDY will get connected to the FINAID server and the broker platform automatically. All buy and sell activities will be conducted automatically.

• Fully transparent. All trading activities can be seen in real time on TRAIDY’s GUI.

• Your account is 100% safe. FINAID does not know, and consequently does not save, any details related to the user’s bank or broker account.

• Your money is at your disposal all the time. Actually, the user is the only person who has direct access to the money in the bank. You can fully liquidate your portfolio or withdraw any amount at any time you wish.

• The live trading results suggest that it’s extremely unlikely that TRAIDY may incur losses for an investing period of 6 months. This means that A) the user can be sure that his/her portfolio is growing consistently over time, and B) he/she can withdraw his/her money any time without being afraid of any potential losses.

• Fully automated. No user intervention is required. TRAIDY will get connected to the FINAID server and the broker platform automatically. All buy and sell activities will be conducted automatically.

• Fully transparent. All trading activities can be seen in real time on TRAIDY’s GUI.

• Your account is 100% safe. FINAID does not know, and consequently does not save, any details related to the user’s bank or broker account.

• Your money is at your disposal all the time. Actually, the user is the only person who has direct access to the money in the bank. You can fully liquidate your portfolio or withdraw any amount at any time you wish.

• The live trading results suggest that it’s extremely unlikely that TRAIDY may incur losses for an investing period of 6 months. This means that A) the user can be sure that his/her portfolio is growing consistently over time, and B) he/she can withdraw his/her money any time without being afraid of any potential losses.

What should I do to use TRAIDY?

The user must have an account with a stockbroker (currently Interactive Broker). Then, the user needs to subscribe to the TRAIDY trading solution.

Once the user completes the subscription, TRAIDY is ready to run, and the help function of TRAIDY explains how to manage the basic settings to make trading activities run autonomously. These settings shall be set only upon the first usage of TRAIDY. Once these settings are saved, there is no need for adjusting them later.

The users need to make sure that TRAIDY and the broker trading platform are running whilst the market is open on a daily basis. Thus, the users need to ensure that their machine has internet connection whilst the market is open on a daily basis. A user must have an account with a stockbroker (currently Interactive Broker). Then, the user needs to subscribe to the TRAIDY trading solution.

Once the user completes the subscription, TRAIDY is ready to run, and the help function of TRAIDY explains how to manage the basic settings to make trading activities run autonomously. These settings shall be set only upon the first usage of TRAIDY. Once these settings are saved, there is no need for adjusting them later.

The users need to make sure that TRAIDY and the broker trading platform are running whilst the market is open on a daily basis. Thus, the users need to ensure that their machine has internet connection whilst the market is open on a daily basis. A user must have an account with a stockbroker (currently Interactive Broker). Then, the user needs to subscribe to the TRAIDY trading solution.

How risky is TRAIDY?

TRAIDY has its own AI-based risk management module. This module encompasses several techniques to alleviate any possible drawdown in your portfolio. These techniques comprise, but are not limited to, A) diversification, B) maximum capital invested in one single stock, C) money management and D) position management.

The live trading results (as shown in the bar chart above) suggest that TRAIDY is much safer than the standard indices, such as S&P500.

The live trading results (as shown in the bar chart above) suggest that TRAIDY is much safer than the standard indices, such as S&P500.

What are the anticipated returns?

The average compounded annualized returns over a period of 5 years is 17% (the annualized standard deviation is 4.5%). This means that TRAIDY will, probably, double your money within 5.5 years (assuming compounded returns). Of course, the actual performance depends on market and economic conditions. Nevertheless, it’s extremely unlikely that TRAIDY may incur losses for an investing period of 1 year.

Fees?

Using TRAIDY creates just two types of costs: obviously, a user will need to subscribe to the TRAIDY solution, the pricing for this can be found on this web site. In addition, the Interactive Broker takes processing fees, as described on their web site.

Security

Security of the Interactive Broker account: Only the user and TRAIDY itself accesses the Interactive Broker account – nobody else does, no credentials are passed or known.

Security of TRAIDY: The trading signals are unlikely to be manipulated, and the FINAID server is well secured.

We encourage the users to secure their computers.

For any technical questions, please contact tech.support@finaid.solutions.

Security of TRAIDY: The trading signals are unlikely to be manipulated, and the FINAID server is well secured.

We encourage the users to secure their computers.

For any technical questions, please contact tech.support@finaid.solutions.

Shall I really trust a “machine” to manage my portfolio?

The majority of hedge funds, nowadays, employ AI-based trading strategies (despite of them having very intelligent people). If you want to know more about the results of adopting AI for financial investment, you may read this article.

The bottom line is: you may not trust a “machine”, but you might well trust the live trading results.

The bottom line is: you may not trust a “machine”, but you might well trust the live trading results.

Is my personal data safe?

Yes.

First of all, FINAID does not know either your Interactive Broker password or your bank account. FINAID only saves your contact details (name, email, phone number), in addition to the current holdings of your portfolio (which is normal and necessary since TRAIDY will be responsible for managing your portfolio). Moreover, all data at FINAID’s server are encrypted.

Which brokers does TRAIDY support?

The current version of TRAIDY supports Interactive Broker TWS.

Can I trade FOREX or Crypto using TRAIDY?

Currently, you cannot. The current version of TRAIDY only supports stocks listed in any USA stock exchange (NASDAQ, NYSE...). Further developments are planned.

I have a VPN installed on my machine. Is this a problem?

We do not have any reason to expect any problem in such a case, TRAIDY works normally.

Once working with TRAIDY on my laptop, can I still use my IB mobile app to check out my account?

Unfortunately, you cannot.

The reason is an IB feature, which ensures that each account is not used by two different sources at the same time. In other words, if the user accesses his/her account via IB mobile’s app, the IB platform will close any other connections to the same IB account. In such a case, TRAIDY cannot work anymore.

It is therefore suggested that you do not use your IB mobile app to log into the very account TRAIDY is working with; TRAIDY was designed to work by itself anyway.

Important: In case you forget, and you do use your IB mobile app and log into the TRAIDY associated IB account, please make sure to refresh/re-login the local instance of IB on your laptop.

The reason is an IB feature, which ensures that each account is not used by two different sources at the same time. In other words, if the user accesses his/her account via IB mobile’s app, the IB platform will close any other connections to the same IB account. In such a case, TRAIDY cannot work anymore.

It is therefore suggested that you do not use your IB mobile app to log into the very account TRAIDY is working with; TRAIDY was designed to work by itself anyway.

Important: In case you forget, and you do use your IB mobile app and log into the TRAIDY associated IB account, please make sure to refresh/re-login the local instance of IB on your laptop.

Can I open multiple IB accounts on my laptop (e.g., one account for TRAIDY and the second account is for manual trading)?

Yes, you can.

Just make sure that TRAIDY is correctly connected to the IB account associated with it. A kind reminder: please make sure that the settings of the IB account associated with TRAIDY are well configured (see point 5. above). Any other IB accounts not associated with TRAIDY shall not have the same API settings as the TRAIDY IB account. TRAIDY will be only connected to one single IB account on one machine. For additional help or inquiry, contact us at tech.support@finaid.solutions

Just make sure that TRAIDY is correctly connected to the IB account associated with it. A kind reminder: please make sure that the settings of the IB account associated with TRAIDY are well configured (see point 5. above). Any other IB accounts not associated with TRAIDY shall not have the same API settings as the TRAIDY IB account. TRAIDY will be only connected to one single IB account on one machine. For additional help or inquiry, contact us at tech.support@finaid.solutions

Please contact Us

Contact

FINAID Tech Solutions Ltd.

DIFC Gate Avenue, DIFC Dubai UAE

Dubai

United Arab Emirates

Phone: +971 525218026

Services

Coming soon

Forex trading

Crypto trading

Halal trading

Mobile trading

COPYRIGHT 2023 BY FINAID Tech Solutions Ltd.